Filing bankruptcy Chapter 7 in Georgia is the fastest and most common form of consumer bankruptcy. Under the protection of a federal court, Chapter 7 Bankruptcy a tool to resolve overwhelming debt. You may have to give up some assets, like an expensive car or jewelry, but the vast majority of people filing for this type of bankruptcy in Georgia do not.

Chapter 7 bankruptcy forgives most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. However, some forms of debt, such as back taxes, court judgments, alimony and child support, and student loans generally aren’t eligible.

Chapter 7 bankruptcy will leave a serious mark on your credit reports for 10 years. During this time you’ll likely find it harder to get credit, meaning you will have massive difficulties getting a home loan, renting, buying another vehicle, getting credit cards, etc. Basically, everything involving credit in your life will be affected. Even so, you’ll probably see your credit scores start to recover in the months after you file.

In this Chapter 7 Bankruptcy article, we will cover:

- Chapter 7 Bankruptcy Process In Georgia

- Sell Your House Fast In Georgia To Avoid Bankruptcy

- Filing Chapter 7: Do You Qualify For Chapter 7 Bankruptcy?

- How Do You File Chapter 7 Bankruptcy?

- Is Chapter 7 Bankruptcy Right For You?

- Pros and Cons for Filing Bankruptcy Chapter 7

- Rebuilding After Bankruptcy

Chapter 7 Bankruptcy Process In Georgia

Sell Your House Fast In Georgia To Avoid Bankruptcy

If you start getting behind on payments, and you think that you are potentially going to be facing foreclosure or bankruptcy in Atlanta, Georgia, then your best option to save your credit and financial hardship is to go ahead and sell your house fast in Atlanta to a company like Breyer Home Buyers.

Most people start getting behind on payments and then don’t take action to liquidate their assets quickly enough to save themselves from foreclosure and bankruptcy. If you can start to liquidate your assets quickly once you hit a financial hardship, you simple lose some material items, avoid the stress and embarrassment of bankruptcy, and avoid a decade of financial struggles.

We can help you sell your house quickly in Georgia. We buy houses in Atlanta Georgia in as little as 14 days, giving you plenty of time to get current on all of your bills and figure out what you need to do to avoid bankruptcy.

If you want to sell your house during the bankruptcy process, we will work with your Bankruptcy Trustee to see what your options are on getting buying your house as they will be the ones who have control of your assets during the bankruptcy process. If they see that your house has enough equity to be sold during the bankruptcy process and pay off your other debts, then they will work with us on selling your house fast during bankruptcy.

If you want to sell your house and you’re facing or dealing with bankruptcy or foreclosure, you don’t want to sell through a Georgia Realtor.

Real estate agents in Georgia will make you:

- Fix up the property

- Show your house to potentially hundreds of people

- Hold open houses

- Pay Realtor commissions and fees

- Pay closing costs

- Wait to sell the house for 6+ months

Breyer Home Buyers will let you:

- Sell as is (no repairs, upgrades, or cleaning)

- Show your house to us and our partners

- Maintain your privacy during stressful times

- Pay zero fees, commissions, or closing costs

- Close on your house, check in hand, in as little as 14 days

We don’t buy every house that we come across, but if you want to get a fair cash offer on your house today to help you avoid bankruptcy, fill out this form or give us a call now. Once you contact us, here’s how our process works.

Filing Chapter 7: Do You Qualify For Chapter 7 Bankruptcy?

To qualify for Chapter 7 bankruptcy you:

- Must pass the means test, which looks at your income, assets and expenses and verifies that you truly aren’t able to cover the monthly debt obligations that you have taken on.

- Cannot have completed a Chapter 7 in the past eight years or a Chapter 13 bankruptcy within the past six years.

- Cannot have filed a bankruptcy petition (Chapter 7 or 13) in the previous 180 days that was dismissed because you failed to appear in bankruptcy court or comply with court orders, or you voluntarily dismissed your own filing because creditors sought court relief to recover property they had a lien on.

How Do You File Chapter 7 Bankruptcy?

You can probably complete the Chapter 7 Bankruptcy process within six months. You’ll have to follow several steps to achieve this, such as the following.

Credit Counseling: Alternative To Bankruptcy

You must complete pre-file bankruptcy counseling from a qualified nonprofit credit counseling agency within 180 days before filing.

Most reputable bankruptcy credit counselors are non-profit and offer services at local offices, online, or on the phone. If possible, find an organization that offers in-person counseling. Many universities, military bases, credit unions, housing authorities, and branches of the U.S. Cooperative Extension Service operate non-profit credit counseling programs.

Be aware that “non-profit” status doesn’t guarantee that services are free, affordable, or even legitimate. In fact, some credit counseling organizations charge high fees, which they made hide; others might urge their clients to make “voluntary” contributions that can cause more debt.

Find A Bankruptcy Attorney In Atlanta Georgia

Before diving into the various forms required to file Chapter 7 Bankruptcy, find a qualified bankruptcy attorney in Atlanta to help. It’s hard to find money for a lawyer when you need debt relief, but this is not a DIY situation. Missing or improperly completed paperwork can lead to your case being thrown out or not having some debts dismissed, which will lead to your debts not being forgiven. This will cost you more in the long run.

File Paperwork Declaring Bankruptcy In Georgia

Your bankruptcy attorney in Atlanta will help with filing your petition and other paperwork. But it’s on you to gather all relevant documentation of your assets, income and debts. An automatic stay goes into effect at this point, meaning that most creditors cannot sue you, garnish your wages or contact you for payment. When facing foreclosure, an automatic stay will essentially block your lender from taking your home away from you until the Chapter 7 Bankruptcy is resolved. This provides you with more time to figure out how to stop foreclosure or avoid foreclosure in Georgia.

Trustee Takes Over: Bankruptcy Trustee

Once your petition is filed, a court-appointed bankruptcy trustee will begin managing the process. This person will manage the assets, the court hearings on your part, and anything else pertaining to the Chapter 7 Bankruptcy. They will be your point of contact during the Georgia bankruptcy process.

Meeting Of Creditors: Bankruptcy Lawyers Near Me

The bankruptcy trustee that is appointed to you will arrange a meeting between you, your bankruptcy lawyer in Atlanta and your creditors. You’ll have to answer questions from the trustee and creditors about your bankruptcy forms and finances.

Your Eligibility Is Determined: Can I File For Bankruptcy In Atlanta?

After reviewing your paperwork, the bankruptcy trustee will confirm whether you’re eligible for Chapter 7 bankruptcy in Georgia.

Nonexempt Property: How Bankruptcies Work Georgia

The trustee determines whether assets that aren’t exempt are worth selling so proceeds can go to creditors. Nonexempt property can be jewelry, or the equity in your house or car if it’s higher than your state’s exemption limit. The majority of individual Chapter 7 cases, however, are “no asset” cases where there are no nonexempt items to liquidate. Nonexempt assets include any property that can be sold by the court.

If you do not have any nonexempt assets, your case is called a “no asset” case. There is no property for the bankruptcy court to sell and your creditors won’t get receive any payment through your case.

Secured Debts: Bankruptcy Payments

To resolve your secured debts through the bankruptcy process in Georgia, the property held as collateral may be ordered returned to the creditor. Or you may be able to redeem the collateral (you pay the creditor what it’s worth now) or reaffirm the debt (arrange to exclude the debt from bankruptcy and continue to pay it back).

If you’ve already filed Chapter 7 bankruptcy, the trustee may let you keep the asset if you can afford to pay the value of the asset. Or, you may be able to exchange a nonexempt asset for an exempt asset.

Education Course: Bankruptcy Help

Before your bankruptcy case is discharged, you’ll have to take a financial education course from a qualified nonprofit credit counseling agency.

Here’s a list of approved Chapter 7 Bankruptcy education courses in Georgia.

Bankruptcy Discharge: How Bankruptcies Work In Georgia

Three to six months after filing your petition, your case will be discharged, meaning that eligible debts are forgiven. Shortly thereafter your case will be closed.

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Is Chapter 7 Bankruptcy Right For You?

Before you proceed with filing bankruptcy Chapter 7 in Georgia, you’ll want to decide if it makes financial sense. You can determine if Chapter 7 bankruptcy is right for you by asking yourself the following questions:

- Are you judgment proof – that is, are creditors legally barred from taking your property or income even if you don’t file for Chapter 7 bankruptcy? The term judgment proof is commonly used to refer to defendants or potential defendants who are financially insolvent, or whose income and assets cannot be obtained in satisfaction of a judgment. Being “judgment proof” is not a defense to a lawsuit.

- Will Chapter 7 bankruptcy discharge enough of your debt to make it worth your while? The person or business that has filed a bankruptcy case is called the debtor. A creditor is any person or business owed a debt on the date the bankruptcy case was filed. A bankruptcy discharge is a court order that eliminates certain debts. The discharge bans creditors from taking collection action on discharged debts.

- Will you have to give up property you want to keep? Most Chapter 7 bankruptcy filers can keep a home if they’re current on their mortgage payments and they don’t have much equity. However, it’s likely that a debtor will lose the home in a Chapter 7 bankruptcy if there’s significant equity that the trustee can use to pay creditors.

Depending on your answers to these questions, you might find out that Chapter 7 bankruptcy won’t help much or, in the alternative, that it is a good choice for you.

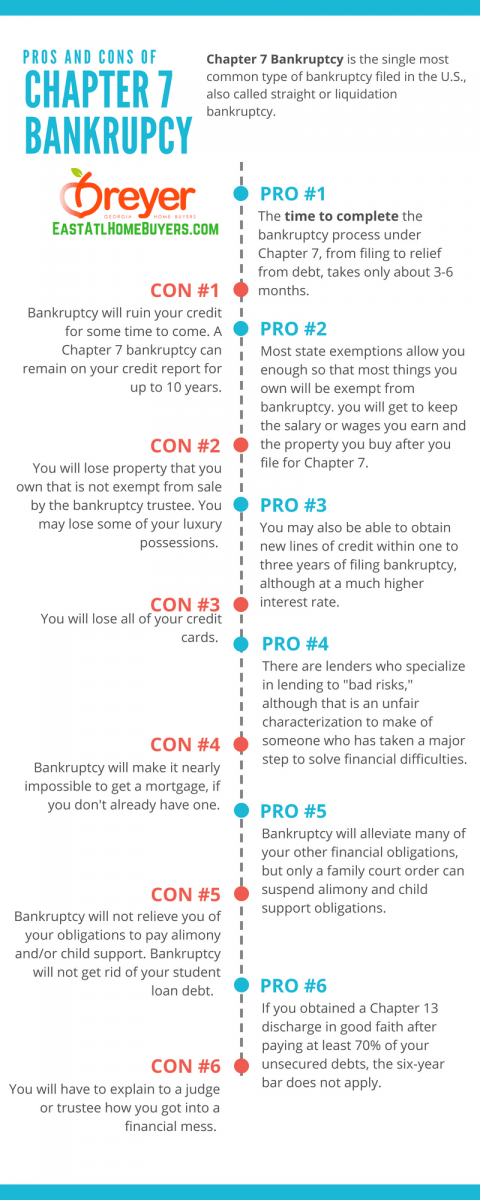

Pros and Cons for Filing Bankruptcy Chapter 7

There are pros and cons to filing Chapter 7 bankruptcy. Check out the infographic below which gives an overview of what the pros and cons are to see if filing bankruptcy Chapter 7 is right for you.

Cons To Filing Bankruptcy Chapter 7 In Georgia

- Bankruptcy will ruin your credit for some time to come. A Chapter 7 bankruptcy in Georgia can remain on your credit report for up to 10 years, affecting your purchasing powers for that decade, regardless of how much income you have and how affordable the purchase is for you.

- You will lose property that you own that is not exempt from sale by the bankruptcy trustee. You may lose some of your luxury possessions. This could be in the form of jewelry, cars, boats, etc.

- You will lose all your credit cards and the ability to get low interest credit cards, if any, for numerous years. Since you will be more ‘high risk,’ only credit cards with high interest rates to mitigate the risk will allow you to sign up.

- Bankruptcy will make it nearly impossible to get a mortgage, if you don’t already have one. Holding onto your house is very important, if you can afford the payments. Filing for bankruptcy in Georgia will make it very difficult to rent as most landlords see filing bankruptcy as inability to make payments and they want a safe tenant in their properties.

- Declaring bankruptcy now might make it harder to do later if something worse comes along. For instance, if you complete the bankruptcy process under Chapter 7, you cannot file for another Chapter 7 bankruptcy for six years. The six years is counted from the date you last filed for bankruptcy, not when it was resolved. If you are under severe financial stress and there’s no way to get out from under your debts, then filing bankruptcy chapter 7 in Georgia is probably your best option at the time.

- Bankruptcy will not relieve you of your obligations to pay alimony and/or child support. Bankruptcy will not get rid of your student loan debt either. These are unforgivable debts. Also remember that not paying child support can land you in jail for a few months to years depending on the severity.

- You may still be obligated to pay some of your debts, such as a mortgage lien, even after bankruptcy proceedings are completed.

- If you file for Chapter 7 relief, but you have a certain amount of disposable income, the bankruptcy court could convert your Chapter 7 case to a Chapter 13, thus changing your plan to be free from most debts within four to six months, to a plan requiring you to repay your debts over the course of three to five years. Chapter 13 bankruptcy is a repayment plan, while filing bankruptcy Chapter 7 will rid you of debts.

Pros To Filing Bankruptcy Chapter 7 In Georgia

- Although a bankruptcy stays on your record for up to 10 years, the time to complete the bankruptcy Chapter 7 process, from filing to relief from debt, takes only about 3-6 months.

- Most Georgia exemptions allow you enough so that most things you own will be exempt from bankruptcy, sometimes allowing more coverage to keep your property than you need. Additionally, you will get to keep the salary or wages you earn and the property you buy after filing bankruptcy Chapter 7.

- There are lenders who specialize in lending to “bad risks,” although that is an unfair characterization to make of someone who has taken a major step to solve financial difficulties. Lenders view people who have filed for bankruptcy as bad risk because they were not able to handle their financial situations, even if it was out of their control, such as medical problems, job loss, etc.

- You may also be able to obtain new lines of credit within one to three years of filing bankruptcy, although at a much higher interest rate. This is where the high interest credit cards come into play. They will give you credit cards, just at higher rates to mitigate their risks.

- Although, you can only file under Chapter 7 once every six years, you can always get a Chapter 13 plan if there is another disaster before you are entitled to file for Chapter 7 again. You may file for a Chapter 13 plan repeatedly, although each filing appears on your credit record, and will compound the negative effects on your credit report and purchasing power.

- Bankruptcy will alleviate many of your other financial obligations, but only a family court order can suspend alimony and child support obligations.

- Both judges and trustees have heard far worse stories than yours. So don’t be too embarrassed about your situation. A lot of people face financial hardships, and the people processing your case deal with this on a daily basis. It’s not your fault that life happens sometimes. They are there to help you get through it.

- You can avoid these harsh limitations against filing for bankruptcy by observing all court orders and court rules, and by not asking to have your case dismissed when a creditor asks for relief from the stay. Even if these limitations apply to you, they don’t last forever. You’re only prevented from filing for six months.

- If you don’t owe money on the type of debts that survive bankruptcy (student loans, child support, etc.), the amount and number of debts that a bankruptcy court can relieve you from paying is potentially unlimited.

- Chapter 7 does not require that you have debts of any particular amount in order to file for relief. However, even if your case gets converted to Chapter 13, it can still improve your financial situation by obtaining more favorable terms to pay off your debts. With Chapter 13, you get to keep all of your property as well.

Rebuilding After Bankruptcy

Although you have the same goal of building credit as just like when you started out, your situation is a little different now. Your problem isn’t a lack of credit history, it’s just that you have a stain on your credit history that slowly fades with time.

First, assess your situation. You can do that by checking your free annual credit reports and monitor your credit score on sites like Credit Karma. Your credit scores are calculated using information in your credit reports, so any inaccurate negative information can make it even harder for you to dig out of debt. If you find errors, dispute them and get them corrected immediately so that you can rebuild your credit more quickly.

Of course, there will be negative information that is accurate. Your reports will show your bankruptcy for 10 years. Also, late payments and debts that go to collection remain on the reports until seven years after the delinquencies. A Chapter 7 filing wipes out debts, but it doesn’t wipe your credit reports clean.

Second, check your credit score. There are several ways to get a free credit score, from personal finance websites like NerdWallet and some credit card issuers. It’s smart to track your credit score month to month, and it’s crucial to look at the same score each time — otherwise, you’ll get a not-useful apples-to-oranges comparison.

Cleaning up your credit reports and knowing which credit score will be seen by lenders helps you know which credit products to apply for.

Post Bankruptcy Geared Products

Your bankruptcy will make you look like an extremely risky borrower to lenders. You can fix that problem by providing extra assurances that they won’t lose money by lending to you. Here are three ways to improve your financial profile that will help you get credit and work on restoring your score:

Secured Loan

Secured loans most often are offered by credit unions or community banks. One kind of secured loan involves borrowing against money you already have on deposit. You won’t be able to access that money while you’re paying off your loan.

Another example is borrowing money against assets that you have which have equity in them already, like your home. If you have a $200,000 house, and you only owe $50,000, then you can normally borrow up to 75% of the value of the home, or $150,000. Since you owe $50,000, this means you could get a secured loan against your remaining $100,000 equity. ($200k x 75% = $150k – $50k (owed) = $100k (borrowable))

Secured Credit Card

This kind of card is backed by a deposit you pay, and the credit limit typically is the amount you have on deposit. A secured card often has annual fees and may carry high interest rates, but you shouldn’t need it for the long term. It can be used to mend your credit until you become eligible for a better, unsecured card.

With this option, you may just be better off having a checking account that and use your debit card. You won’t have to apply and prove to a company that you are worthy of obtaining a credit card.

The downfall with using a checking account instead of a secured credit card would be that you are not building your credit history back up with your checking account. To build your credit up more quickly, you may just have to suck it up and deal with the inconveniences of using a secured credit card instead of a checking account.

Be aware that you can be rejected for a secured card. Read the requirements carefully; you’ll want to be almost certain you can get approved before you apply for one, because each credit inquiry can cause a small, temporary drop in your score. This decline will be more than offset if you get a card, use it lightly, and pay the debt on time.

Co-Signed Credit Card Or Loan

This can help your score, but you need to have a friend or family member with good credit history who is willing to cosign for you. It’s a big ask: A co-signer is risking his or her credit reputation for you, will be on the hook for the full amount if you don’t pay, and may face limits on personal borrowing because of the additional debt obligation. A co-signed card or loan can damage relationships if you don’t pay as agreed.

Can You Sell A Home In Foreclosure In Atlanta?

You could work at trying to find a buyer through a Georgia Realtor to buy your house quickly. However, a faster and easier option is to find an investment firm that buys houses as-is for cash, fast. Instead of spending all of your time and energy trying to locate a buyer with a Realtor in Georgia, there are many companies that can do this for you. Companies like Breyer Home Buyers will buy the house from you at a reduced price, and very quickly.

We understand that the possibility of losing your home due to foreclosure can be stressful. You aren’t alone. Citizens all over Atlanta are going through the same troubles. Foreclosure can have a lasting effect on your financial life, and it’s important to move quickly and take advantage of any options available. You could save both your credit rating and remain in your home.

We may be able to help you avoid foreclosure… connect with us today and let’s discuss your situation. We don’t charge any fees… we’ll evaluate your situation… and present you your options so you can move forward and get this foreclosure behind you.